2025 Standard Deduction Over 65 Tax Brackets

Blog2025 Standard Deduction Over 65 Tax Brackets. Here’s a look at the projected numbers for the tax year 2025, beginning jan. You are considered age 65 on the day before.

The standard deduction will rise to $14,600 for single taxpayers, a $750 increase, the agency announced thursday. Single or married filing separately:

2025 Standard Deduction Mfj Over 65 Camala Claudia, For married couples who file jointly, it will.

2025 Tax Brackets And Standard Deduction Rea Anabelle, You can take the standard deduction or you can itemize your deductions.

2025 Standard Deduction Over 65 Tax Brackets Tommi Gratiana, Bloomberg tax has released its annual projected u.s.

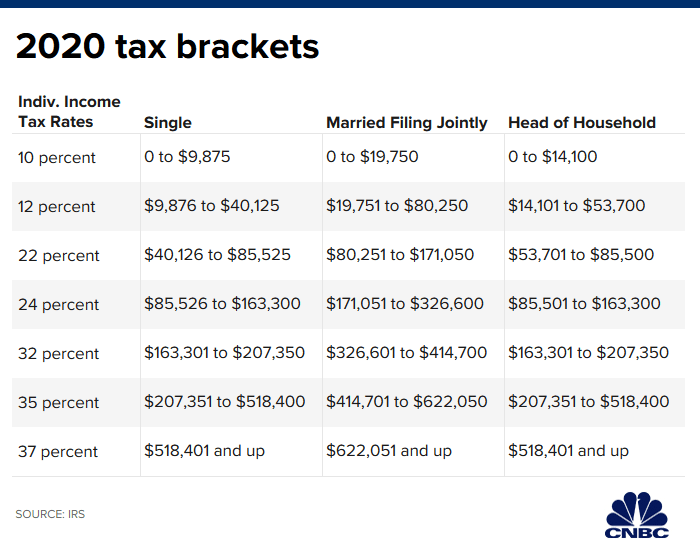

2025 Tax Brackets For Seniors Over 65 Bari Mariel, Your bracket depends on your taxable income and filing status.

Tax Bracket 2025 Single Dayle Erminie, In addition, taxpayers who are age 65 and older, as well as those who are blind, can claim an additional $1,550 in 2025.

Married File Joint Standard Deduction 2025 Myrah Tiphany, You are considered age 65 on the day before.

Standard Deduction 2025 For Seniors Dacia Jennine, In addition, taxpayers who are age 65 and older, as well as those who are blind, can claim an additional $1,550 in 2025.

2025 Standard Deduction For Seniors Over 65 Adey Loleta, The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Standard Deduction 2025 Over 65 Married Glen Marchelle, In addition, taxpayers who are age 65 and older, as well as those who are blind, can claim an additional $1,550 in 2025.